The government announced today (22/03/2020) it will inject A$66.4 billion into the economy as part of a second stimulus package to shelter the country from the financial impact of the coronavirus.

These actions provide timely support to affected workers, businesses and the broader community.

The key business tax measures include modified cash flow assistance for employers:

- The previously announced tax-free payment of $25,000 for employers under $50m turnover (based on prior year) will be increased to $50,000.

- The minimum payment will be increased from $2,000 to $10,000, and will include Not For Profits.

- The payment will be based on 100% (instead of 50%) of the PAYGW amount reported in the activity statement from January to June 2020.

- An additional payment equal to this amount will also be available from July to October 2020, taking the total available payments to $100,000 (minimum $20,000).

- The payments will be automatically credited by the ATO through the activity statement system.

- The payments will only be available to active eligible employers (other than charities) established prior to 12 March 2020.

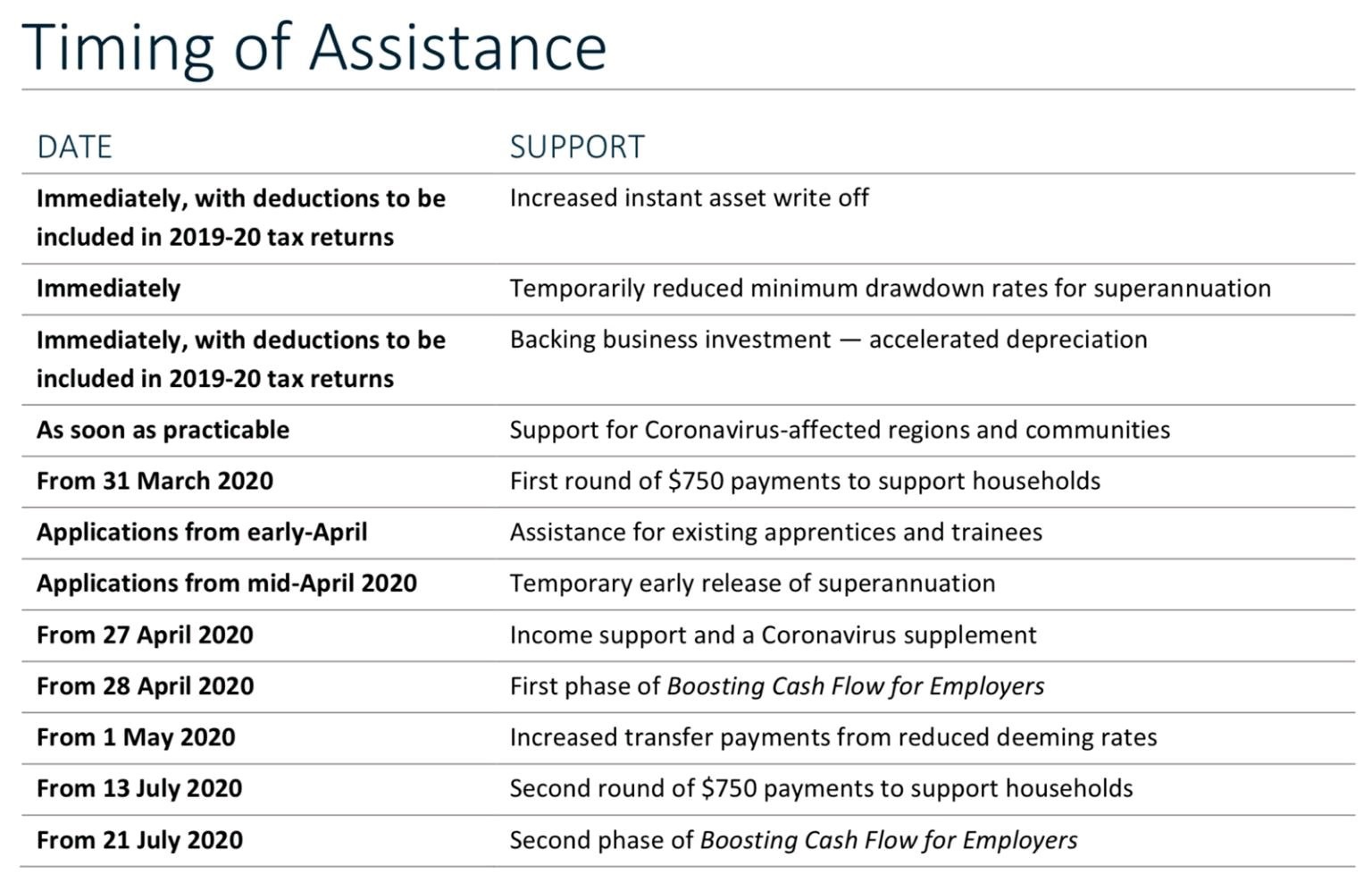

There is no change to the other measures previously announced on 12 March:

- Increased Instant Asset Write Off i.e. increased asset threshold of $150,000 and turnover threshold of $500m until 30 June 2020;

- Limited 50% depreciation incentive until 30 June 2021;

- 50% wages subsidy for apprentices and trainees until 30 September 2020

The key superannuation and income support measures are:

- Tax-free early access to superannuation, up to $10,000, from mid-April to before 1 July 2020. Up to a further $10,000 will be available from 1 July 2020 for approximately 3 months. Must apply to the ATO. Separate arrangements will be made for SMSFs. Conditions apply:

- unemployed;

- eligible for a job seeker payment; or

- on or after 1 January 2020:

i. made redundant;

ii. reduction in working hours by 20% or more; or

iii. if a sole trader

iv. the business was suspended or reduction in turnover of 20% or more.

- Halving of minimum pension drawdown requirements (i.e. 4% → 2%) for 2019–20 and 2020–21.

- The previously announced $750 payment for income support recipients and concession card holders will now be two separate payments: one from 31 March 2020 and the other from 13 July 2020. There will also be a new time-limited Coronavirus supplement to be paid at a rate of $550 per fortnight from 27 April for the next 6 months.

- Income support recipients will also have:

a. expanded access

b. reduced means testing

c. reduced waiting times

d. claims accelerated

e. the application process streamlined

Here is a copy of the Government’s Economic Response from Sunday 22 March 2020.

Victorian Assistance

The Victorian Premier, Daniel Andrews, announced the Victorian Government’s $1.7b Economic stimulus package in response to the impact of the coronavirus on 21 March 2020. This announcement is very welcome. Under the package:

- Small- and medium-sized businesses with payroll of less than $3m will be eligible for full refunds of payroll tax for 2019–20

- cash payments will start flowing next week and will save eligible business up to $113,975 a year. This assistance is a cash refund, not a loan;

- the same businesses will be able to defer any payroll tax for the first 3 months of 2020–21 until 1 January 2021;

- Commercial tenants in government buildings can apply for rent relief — a move private landlords are also being encouraged to undertake;

- 2020 land tax payments will be deferred for eligible small businesses;

- The Vic Government will pay all outstanding supplier invoices within 5 business days; and

- The hospitality sector will be supported by liquor licensing fees being waived for 2020 for affected venues and small businesses.

Other Assistance

Small business loans – relief package. Australian banks will provide support to eligible small businesses by deferring loan payments for up to six months, where assistance is required as a result of COVID-19. The intention is for banks implement this as soon as possible.

We understand the COVID-19 situation may create uncertainty or financial pressure for some of our clients. We care and we are here to help you.

We would like to assure you that we are committed to maintaining the service and care you’ve come to expect from us as your accountants. We have all the resources we need for us to continue delivering you a seamless client experience.

From the team at Rose Partners, we wish you and your family best wishes to stay safe and healthy over the coming months. We’re here to help you in any way we can.

If you have any questions or need any help applying for or ensuring you receive all available assistance, please reach out to our team at Rose Partners and we will endeavour to do our best to assist.