On 12 November 2025, the ATO released an important draft tax update that signals a significantly stricter approach to claiming tax deductions for holiday homes and other properties that are rented out for part of the year but also used privately (or by family/friends).

While the guidance is still open for consultation until 30 January 2026 and not yet finalised, we recommend treating this as the likely future position and reviewing your arrangements now.

What’s Changing?

The ATO has revised its approach to how holiday homes are treated for tax purposes. Specifically, the ATO now classifies certain holiday homes as “leisure facilities”. This new classification means that owners of holiday homes used primarily for personal purposes can no longer claim deductions for ownership expenses like mortgage interest, council rates, land tax, and maintenance. These expenses will instead be included in the property’s cost base, which will help reduce any capital gain when the property is eventually sold.

Direct renting expenses (e.g., advertising, cleaning, agent commissions) will still be tax deductible.

A key red flag for the ATO is blocking out or personally using the property during peak/high-demand periods (e.g., school holidays, summer, events), even if only for a few weeks per year. This can tip the property into “leisure facility” territory, regardless of how many days it is rented out overall.

ATO Risk Zones – Where Does Your Property Sit?

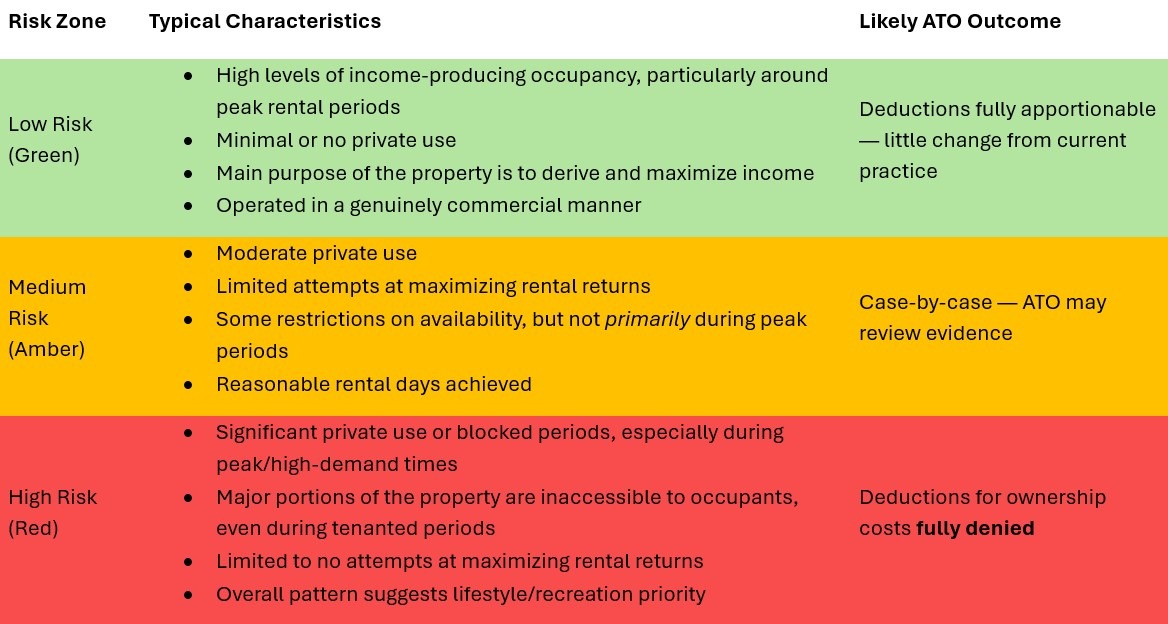

The ATO has introduced risk zones to help taxpayers self-assess. Here’s a simplified summary:

If your holiday home falls into the Medium or High Risk zones, you could lose deductions for most of your largest ongoing expenses from as early as the 2025–26 income year (with full enforcement expected from 1 July 2026).

For properties owned or under arrangement before 12 November 2025, the ATO has stated they will generally not devote compliance resources to applying the new stricter view for income years ending 30 June 2026 or earlier. This gives some breathing space, but planning now is still critical.

Next Steps If You Think You May Be Affected

- Maintain good record keeping — booking calendars, listing history, pricing evidence, and any rejected bookings.

- Review your current and future usage patterns — particularly whether you block or use the property during peak periods.

- Consider changes — making the property genuinely available year-round (including peaks) at market rates, or ceasing private use altogether, may preserve deductions.

- Tax planning opportunities — changing lending arrangements or even selling may be worth exploring before the rules tighten.

If you have further doubts or wish to discuss further, please contact our office. We can help you assess your exposure and implement strategies to minimise any adverse impacts.

As always, we are here to help you navigate these changes smoothly.

The Team at Rose Partners